Gasoline may stay cheap until we burn through the current market glut in perhaps a year.

[This article was written as a companion piece to Roger Baker’s Rag Blog article, “Risky business in Central Texas: The toll road bond gamble.”]

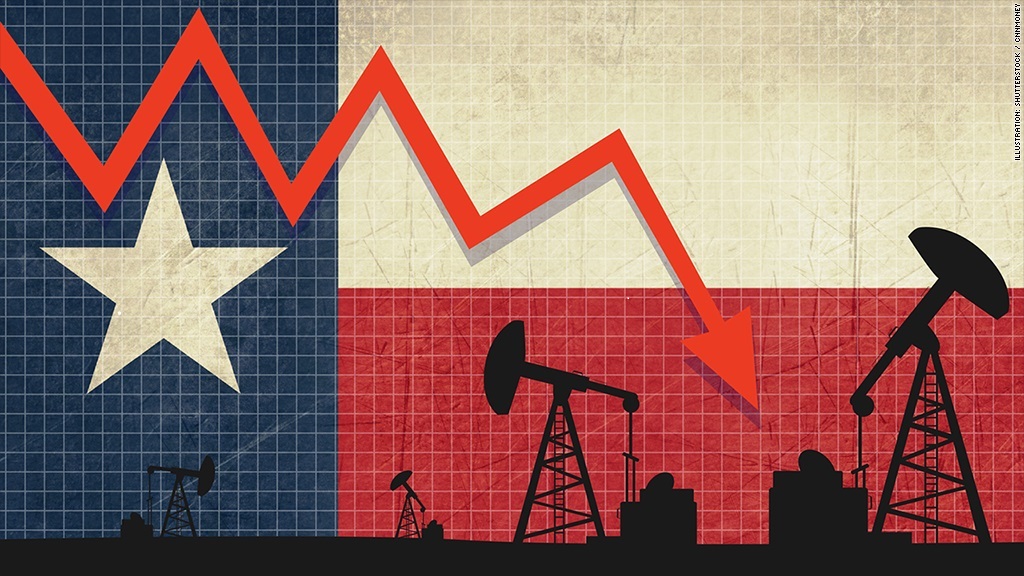

AUSTIN — We are now seeing declining growth and a deflationary economic contraction globally. In fact, the current $40-plus a barrel oil price is by itself good proof of that. The global collapse in the price of oil shows that with global supply remaining roughly constant over time at about 95 million barrels per day. The current low oil price, together with a price slump in other industrial commodities like iron ore, is really an indication of a broad and deep contraction in the global economy, much like 2008-2009.

The Texas shale drilling industry was supposed to keep us driving normally forever, or at least until the economy could recover enough so we could afford to make a transition to electric cars, right? Everyone connected to Wall Street and its financial followers with any media influence were saying that only about a year ago. Then the global oil price gradually collapsed from over $100 a barrel in mid-2014, down to its current price of about $45.

Continue reading