Just the Facts: Taxes, Debts, and National Prosperity

By Sid Eschenbach / The Rag Blog / August 3, 2009

For the past 30 years, conservative Republicans have been able to dominate the economic policy debate by controlling the framework of the argument, by building an economic ‘theory’ based on the celebration of greed, by selling the erroneous belief that that high taxes create low growth, and that low taxes create high growth. As no one, rich or poor wants to pay taxes, it was an easy sell. Unfortunately, if we didn’t suspect it’s legitimacy before, we confirmed the lie in September of 2008 when all the houses built on greed collapsed.

Amazingly, today, under a very different presidency than the Reagan presidency that started the disaster, we still hear Republicans advance the same ‘Atlas Shrugged’ narrative; that we’re overtaxed as a nation, that big government and high taxes stifle healthy economic growth, and that Obama’s financial recovery spending combined with health care spending will create big government and massive deficits that will bring hyperinflation and/or slavish indebtedness.

Just this week, after seeing evidence that the Obama Recovery Act has dramatically helped the local, state and national economies, we hear more from the party line: economist Randall Pozdena said the temporary boost will ‘hurt the economy in the long run because taxes will rise.’ “The question is, are you spending money productively?” said Pozdena, managing director of ECONorthwest, a consulting firm in Portland, Ore… as though buying flat-screen TV’s made in Korea was the highest, best and most productive use of capital.

Unfortunately for the nation, the Democrats don’t challenge the premise and continue to commit the fundamental error of fighting the battle on the opponent’s terms. Until they slay that dragon and redefine the conversation, neither the discussion nor the policies will evolve in a more prosperous direction. Therefore, a review of the actual economic record is urgently needed in order to escape from the Reagan framework and free policymakers and voters alike from a mistaken premise… and allow them to hold a real debate about the merits and the affordability of healthcare reform. Finding answers to the following five questions may help in this regard:

- Are rates of taxation related statistically to rates of national economic growth?

- Are U.S. taxes high by historic U.S. standards?

- Does U.S. national debt represent a threat to the U.S. economy?

- Is the U.S. government large or small by international standards?

- What is the ‘proper’ size of government (or, is big government bad government)?

Are rates of taxation related statistically to rates of national economic growth?

Since the 1980’s, it has been advanced as economic fact that high tax rates create low growth rates, and that low tax rates create high growth rates. This theory of the relationship of taxes to growth is at the heart of neo-liberal economics, and has come to form a major pillar of conservative Republican politics. Over the past three decades it has been successfully used to brow-beat, mislead, fear-monger and usually defeat efforts to raise taxes at local, state and national levels in order to balance budgets and provide public services without going into debt. However, a review of the historical record shows there is absolutely no proof of any statistically significant relationship of that ‘fact’ being true over the past century of American history. Indeed, to the degree that there is a relationship at all, it appears to be the reverse; that higher taxes create higher growth, while lower taxes create lower growth.

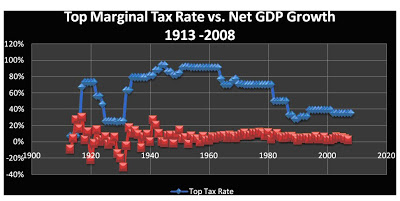

The following chart shows the relationship between economic growth (net GDP growth year by year) and tax policy (as represented by the highest marginal rate) for every year from the first national income tax (1913) to the present. As can be seen, the first 30 years are entirely inconclusive regarding any relationship between taxation and growth, probably explained by the much bigger effects that World War I, the Great Depression and World War II had on the national economy during that period… and the wild swings in both taxation and growth produced by them.

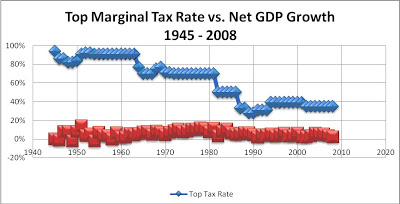

Therefore, if there is a relationship at all we should see it from 1945 to the present, a relatively stable and consistent period of modern American History. The second graph (below) shows that period by itself, again with figures for each year of both net GDP and highest marginal rate of taxation.

According to neo-liberal theory, with the top marginal tax rate over 70% for the first 37 years of the post war period (and over 90% for 15 of those years), and the top marginal tax rate under 40% for the past 26 years, we should see very low growth rates for the first 37 years, and very high growth rates over the past 26 years… but we don’t. Indeed, to the degree that there is a relationship, it is just the reverse. The years of highest growth are in the 38 high tax years (6.04% average GDP growth), and the years of lowest growth are in the 26 low tax years (4.8% average GDP growth). The growth rate in the high tax years is 26% higher on average than the low tax years.

The statistical correlation, the ‘p’ value for the post war period to the present is ‘.14’. To put this result in medical terms, if a company ran tests on a drug to determine its effectiveness and came up with an equivalent p value, they wouldn’t even bother to present it to the FDA, as it would have demonstrated no statistical treatment efficacy. Furthermore, the stock value of the company that had produced those results would take a major hit… something that the Republican proponents of their economic ‘drug’ with a similar failed outcome took in the last elections, as the effectiveness of their ‘drug’ was finally revealed to the world.

In this case of the economic data, while it doesn’t prove statistically that high tax rates cause high growth, it doesn’t even pass a laugh test insofar as supporting the argument that high rates cause low growth and low rates cause high growth. In passing, it is also worthwhile to note that the extraordinarily high tax rates of the post-war period didn’t, as predicted by Ayn Rand, Arthur Laffer and President Reagan, discourage all the creative, intelligent, educated hard working people from working… something that most seemed to do all through the 50’s, 60’s, and 70’s. Indeed, the period is marked by robust growth and unrivaled generalized prosperity.

The economic truth is that growth rates within an economy are the sum of many factors, a short listing of which would include labor policy, trade policy, educational levels, wars, political stability, social and entrepreneurial culture, tax policy, the quality of the legal system, transportation infrastructure, etc. What makes it worse is that the importance of these and other factors vary in importance over time and place, so it’s very difficult to attribute to any one of them a primal importance relative to growth… of the sort attributed to tax policy by the Republicans.

What the data shows very clearly is that over the length of the American experiment, there is NO statistical basis whatsoever to the argument that a high tax environment slows growth, or that a low tax environment spurs growth, and if Ronald Reagan ran a drug company, he’d now be bankrupt. More importantly, it means that anyone who advances that particular lie is just doing just that…. lying.

Are U.S. taxes high by historic standards?

Another of the mistaken premises neo-liberals have been successfully able to insert into discussions about public policy is that U.S. tax rates are ‘too high’… that Americans are ‘over-taxed’, that that ‘over-taxation’ threatens productivity (see above), and the solution to this supposed problem is to lower taxes and, not incidentally, shrink government. As can be seen in the following graph, American tax history can be divided into 8 major tax eras, the last of which being the one we are currently in, from 1987 – 2009. As can also be seen, the current maximum marginal tax rate of 34% is the second to lowest top rate ever paid by Americans, and by far the lowest of the past 80 years. So much for being overtaxes by historical standards.

It comes as a shock to many Americans that during the period generally considered by economists to be the most robust and prosperous of our history, the period from 1945 to 1980, Americans paid maximum rates that averaged over 70% and went over 90% for 15 years… or nearly three times as high as is paid today by the wealthiest Americans. Never bothered by facts standing in the way of a good theory, however, there is still constant carping that the U.S. is ‘overtaxed’ and that that is the reason we’re not as prosperous as we once were. It’s nothing but greed masquerading as reason, and its pure nonsense.

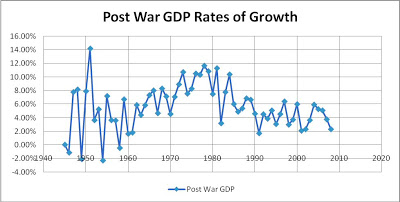

As regards the previous point, the argument that low taxes create high productivity, the following chart shows clearly the GDP growth rates over the postwar period. Keep in mind when looking at these rates that taxes after 1980 were much lower (50% lower) than before 1980. What does that say about the relationship between taxes and productivity?

Does U.S. national debt represent a threat to the U.S. economy?

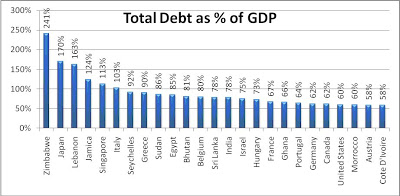

We hear on a daily basis from Republicans that Obama’s spending on healthcare and the stimulus will ‘destroy’ the economy. While they’re sure it’ll get destroyed, they’re not sure exactly how… but they generally offer either of two scenarios; through hyperinflation or by ultrahigh taxes on our children and grandchildren (see the first question above to understand the independent absurdity of this ‘threat’), Could they be right, at least about hyperinflation? Is the current or forecast U.S. government debt really a systemic or socio-economic threat?

The following graph is helpful in understanding how far the U.S. actually is from such a threat… to the degree that it can even be taken at face value (the idea that the world’s largest and only internationally recognized trading currency would be subject to hyperinflation is absurd on it’s face… but again, that’s never stopped a Republican economic argument before.) The U.S. would have to run a deficit of over two trillion dollars a year for the next 10 or so years just to catch up to Japan… which not incidentally doesn’t appear to be doing so badly now with their 170% rate. In short, the argument is absurd, and Japan proves it if nothing else.

Is the U.S. government large or small by international standards?

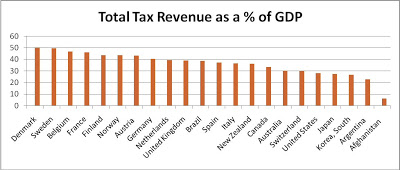

This is not a question that would have mattered as much 40 years ago, but as the globe shrinks with advances in communication and transportation, relative national tax rates and total tax revenues become more important. The argument made by conservative Republicans is that if taxes are too high in the U.S., the highly mobile international businesses will simply move elsewhere, and that will hurt the domestic economy. As the following chart shows, the size of the total tax revenue as a percentage of GDP in the U.S. is among the lowest of all the industrialized nations. If the general assertion that higher taxation invariably produces lower growth were true, then all the countries shown below that have higher total tax burdens as a percent of GDP than the U.S. does (some nearly double) should be withering while those below the U.S…. Afghanistan for example, with its total tax burden of 6%… should be prospering. Of course, none of those predictions based upon the ‘high tax low growth’ theory are in fact true. Afghanistan is not prospering, and Germany is not withering. There is clearly something else at play here, but as long as the Republicans can frame the debate in the ‘high tax = low growth’ context, those other factors that lead to growth will be neither identified nor fortified.

What is the proper size of government?

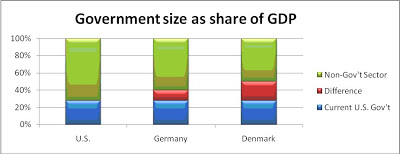

The above chart clearly shows that economies can be successful, even thrive, at much higher tax burdens than currently set in the U.S. As that is the case, a question policy makers must ask (after they have freed themselves from the ‘high tax = low growth dogma’) is the fourth… what is the ‘proper’ size of government?

Unfortunately, there is no simple answer to this question other than that there are no simple answers… such as the ‘government bad, big government worse’ mantric nonsense peddled by ‘conservative’ Republicans. In government, as in much else, size is far less important than efficiency and goals. It should be obvious that a good big government is better than a bad small government… but thanks to Reagan, it’s not seen that way. There are many who still laugh at the joke he used to great effect: “Hello, I’m from the government, and I’m here to help”. They don’t laugh when they call the police, and they don’t laugh when they drive on public highways; they don’t laugh as they send their children to free public schools or sleep safely in their homes at night, and they don’t laugh when they visit the majestic national parks or pick up their unemployment checks… but as no one wants to pay taxes, Reagan’s joke made it o.k. to scorn and belittle the very government that does and must do all those essential things.

This last graph, however, can give us an idea of what other successful countries spend on their governments, and shows the gap between what they spend and what is currently spent in the U.S. As shown, the U.S. currently spends about 28% of GDP on government, Germany about 40%, and the Danish spend 50%. In dollar terms, the actual amounts represented by the red (difference) sections in the German and Danish column equal, for the U.S. economy, an additional $1.7 trillion in spending if the U.S. were to spend at the Germans rate, and an additional $3.1 trillion if the U.S. were to spend at the rate of the Danish.

In other words, there is no economic reason whatsoever that the U.S. couldn’t easily provide healthcare AND balance the budget AND have a healthy economy if it so desired. The only reason it “can’t” be done is because opinion makers and policy writers are still thinking from inside the box that Ronald Reagan built and put them into: they are still thinking that more taxes will necessarily hurt the economy (FALSE), that we are overtaxed as a nation (FALSE), and that big government is necessarily bad government (FALSE).

In Review:

- Are rates of taxation related statistically to rates of national economic growth? NO.

- Are U.S. taxes high by historic U.S. standards? NO.

- Does U.S. national debt represent a threat to the U.S. economy? NO.

- Is the U.S. government large or small by international standards as a share of GDP? SMALL.

- What is the ‘proper’ size of government (or, is big government bad government)? NO.

What all of this proves is that greed and power never go out of style, and the Republican economic theories are all about both. To the degree that the rich keep more money and deny funds to the government, they are able to control government and dominate political discourse. Unfortunately, their economic theories combined with their greed and desperate grasping at power brought the world to a standstill in September of 2008. However, nothing will change unless Democrats slay the premises that created the disaster and set economics… and the nation, on a sounder path.

[Sidney Eschenbach, 60, lives and works in Guatemala, Central America. His thoughts regarding developmental economics and trade are based on decades of development work in Latin America at various levels, community and corporate.]

This is the best article I’ve ever read on our economic policy (delusion) and that of other countries. The charts are great, especially the couple comparing our taxes from the 30s to now and the GDP compared to the level of taxes. Thanks for writing it.